As global commerce becomes increasingly borderless, businesses are seeking flexible structures that reduce overhead while maintaining full legal and commercial credibility. In this context, virtual office services in Türkiye have emerged as a highly effective solution for foreign investors, startups, digital entrepreneurs, and multinational companies expanding into the Turkish market.

Table of Contents

- What Is a Virtual Office in Türkiye?

- Legal Framework for Virtual Offices in Türkiye

- Who Benefits Most from Virtual Office Services?

- Virtual Office vs. Physical Office: Key Differences

- Virtual Offices for Different Company Types

- Tax, Accounting, and Compliance Considerations

- Corporate Governance and Virtual Offices

- Contractual and Commercial Operations

- Banking and Virtual Office Companies

- Common Misconceptions About Virtual Offices

- When a Virtual Office May Not Be Suitable

- Why Choose Akkas CPA & Turkish Accounting Firm?

- Contact us for Virtual Office Services in Türkiye

At Akkas CPA & Turkish Accounting Firm, we have been advising international and local clients on company formation and corporate governance in Istanbul since 2017. With years of hands-on experience, we understand how virtual office arrangements fit into Türkiye’s legal, tax, and commercial framework—especially in 2026, where regulatory scrutiny and compliance expectations are higher than ever.

Our company formation lawyers team provides a comprehensive overview of virtual office services in Türkiye, their legal basis, advantages, limitations, and how they integrate with broader corporate and governance requirements.

What Is a Virtual Office in Türkiye?

A virtual office in Türkiye is a legally recognized business address that allows companies to register, operate, and receive official correspondence without leasing a physical office space. Virtual offices typically include:

- A registered commercial address

- Mail handling and forwarding

- Access to meeting rooms (on demand)

- Reception and secretarial services

- Compliance-ready address documentation for authorities

Importantly, a virtual office is not a shell or informal arrangement. When structured properly, it is fully compliant with Turkish Commercial Code and tax regulations.

Legal Framework for Virtual Offices in Türkiye

Under Turkish law, every company must have a registered address within Türkiye. Virtual office providers meet this requirement by offering addresses approved for commercial registration.

Virtual offices are commonly used during or after company formation in Türkiye, provided that:

- The address is eligible for trade registry registration

- A valid lease or service agreement exists

- The address can receive tax notifications and inspections

When these conditions are met, tax offices and trade registries generally accept virtual office addresses without issue.

Who Benefits Most from Virtual Office Services?

Virtual office services in Türkiye are particularly suitable for:

- Foreign entrepreneurs testing the Turkish market

- Technology and software companies

- Consulting, trading, and e-commerce businesses

- Holding companies and regional headquarters

- Investors establishing a presence before scaling operations

For foreign founders, working with experienced Turkish company formation lawyers is critical to ensure the virtual office structure aligns with both corporate and tax compliance standards.

Virtual Office vs. Physical Office: Key Differences

| Aspect | Virtual Office | Physical Office |

|---|---|---|

| Cost | Low fixed cost | High rent & overhead |

| Flexibility | Highly flexible | Long-term commitment |

| Compliance | Fully compliant if structured correctly | Fully compliant |

| Scalability | Easy to upgrade | More complex |

| Market entry speed | Fast | Slower |

In 2026, cost optimization and agility are decisive factors, making virtual offices an increasingly strategic choice.

Virtual Offices for Different Company Types

Joint Stock Companies (A.Ş.)

Joint stock companies often use virtual offices during early-stage operations, holding structures, or investment phases. With proper governance and documentation, a virtual address is fully acceptable for joint stock company formation and ongoing compliance.

Limited Liability Companies (Ltd. Şti.)

Limited liability companies are the most common users of virtual office services in Türkiye. They are particularly well-suited for limited liability company formation due to their flexibility, lower capital requirements, and simplified management structure.

Tax, Accounting, and Compliance Considerations

A virtual office does not exempt a company from its statutory obligations. Companies must still comply with:

- Corporate tax and VAT filings

- Statutory bookkeeping

- Payroll (if employees exist)

- Financial reporting obligations

Therefore, virtual office users typically integrate their setup with professional accounting & bookkeeping services to ensure seamless compliance.

In addition, companies must meet annual statutory obligations such as annual report filing, regardless of whether they operate from a physical or virtual office.

Corporate Governance and Virtual Offices

Corporate governance is not about where a company is located—it is about how it is managed, documented, and controlled. Virtual office companies must still comply with best practices in corporate governance, including:

- Proper board and shareholder resolutions

- Accurate statutory books

- Transparent management structures

- Clear authority and representation rules

A well-designed governance framework mitigates risks during audits, disputes, or due diligence processes.

Contractual and Commercial Operations

Companies operating via virtual offices routinely enter into commercial agreements with clients, suppliers, and partners. These contracts must be carefully structured to reflect the company’s legal status, address, and authority framework.

Professional contract drafting & review is essential to ensure that agreements executed under a virtual office structure remain enforceable and commercially sound under Turkish law.

Banking and Virtual Office Companies

Opening a corporate bank account in Türkiye is possible for companies using virtual offices, provided that enhanced due diligence requirements are met. Banks typically assess:

- Company structure and shareholders

- Business activity and source of funds

- Governance documentation

- Physical presence rationale

Expert support during bank account opening significantly increases approval success, especially for foreign-owned companies.

Common Misconceptions About Virtual Offices

Despite their popularity, virtual offices are often misunderstood. Common misconceptions include:

- “Virtual offices are illegal” – Incorrect when properly structured

- “Tax authorities automatically reject them” – Not true with compliant providers

- “Banks refuse virtual office companies” – Oversimplified and outdated

In reality, the key factor is legal and operational substance, not physical space.

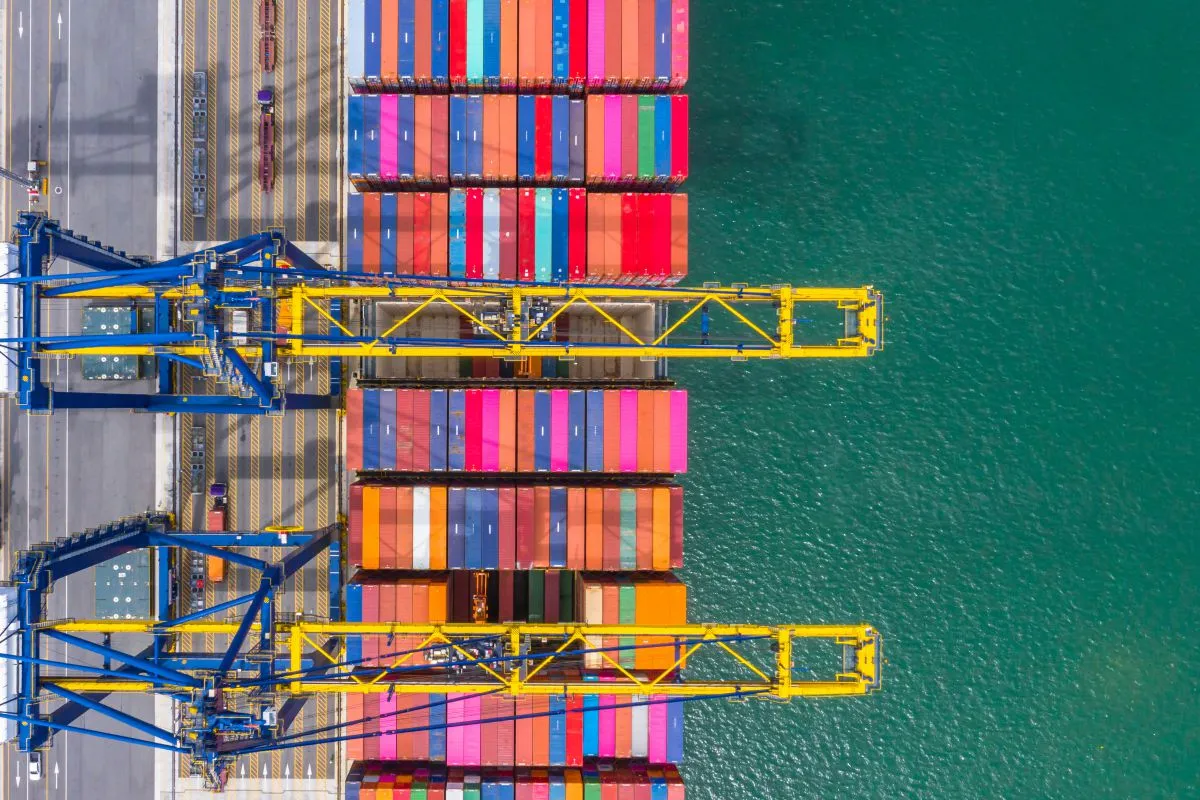

When a Virtual Office May Not Be Suitable

Virtual offices may not be ideal for:

- Manufacturing or logistics companies

- Retail businesses requiring customer access

- Companies with large local teams

- Highly regulated sectors requiring physical premises

In such cases, hybrid or serviced office models may be more appropriate.

Why Choose Akkas CPA & Turkish Accounting Firm?

At Akkas CPA & Turkish Accounting Firm, we do not treat virtual office services as a standalone product. Instead, we integrate them into a holistic corporate strategy that includes:

- Company formation and restructuring

- Tax and compliance advisory

- Governance and shareholder relations

- Banking and commercial operations

Our Istanbul-based, multilingual team has been advising international investors since 2017, ensuring that every structure we implement is compliant, practical, and future-proof.

If you are considering virtual office services in Türkiye—or wish to combine them with company formation, governance, or compliance support—we invite you to contact Akkas CPA & Turkish Accounting Firm. Our experienced legal team will assess your objectives and design a tailored, fully compliant solution for your business in Türkiye.

Since 2017, Akkas CPA & Turkish Accounting Firm has remained Istanbul’s trusted partner for business establishment and financial compliance.

Beyhan Akkas, CPA & Accountant

Contact us for Virtual Office Services in Türkiye

Navigating the complexities of virtual office registration and corporate compliance in Türkiye requires experienced legal guidance. At Akkas CPA & Turkish Accounting Firm, we have been providing comprehensive company formation and governance services in Istanbul since 2017.

Our multilingual team of legal professionals specializes in helping international and domestic clients establish and maintain compliant, efficient business operations in Türkiye.

Whether you need assistance with virtual office registration, corporate structuring, ongoing compliance, or any aspect of Turkish business law, our dedicated team is ready to support your success. Contact Akkas CPA & Turkish Accounting Firm today to discuss how our tailored legal solutions can help you achieve your business objectives in Türkiye with confidence and peace of mind.