Establishing a free zone company in Türkiye represents a strategic decision that can significantly impact your international business operations and long-term profitability. With over three years of experience since 2017, Akkas CPA & Turkish Accounting Firm has guided hundreds of international clients through successful free zone company formations across Türkiye.

Our multilingual team of specialized corporate lawyers provides comprehensive support throughout the entire establishment process, from initial zone selection and business planning through final licensing and operational commencement. We deliver personalized service that accounts for your specific industry requirements, strategic objectives, and operational preferences.

Table of Contents

- Understanding Free Zones in Türkiye

- What Is a Free Zone in Türkiye?

- Key Advantages of Free Zone Company Formation in Türkiye

- Types of Legal Entities in Turkish Free Zones

- Who Can Establish a Free Zone Company?

- Step-by-Step Free Zone Company Formation Process

- Required Documents for Free Zone Company Formation

- Taxation of Free Zone Companies in Türkiye

- Costs of Free Zone Company Formation

- Banking and Financial Operations

- Governance and Ongoing Compliance

- Contact us for Free Zone Company Formation in Türkiye

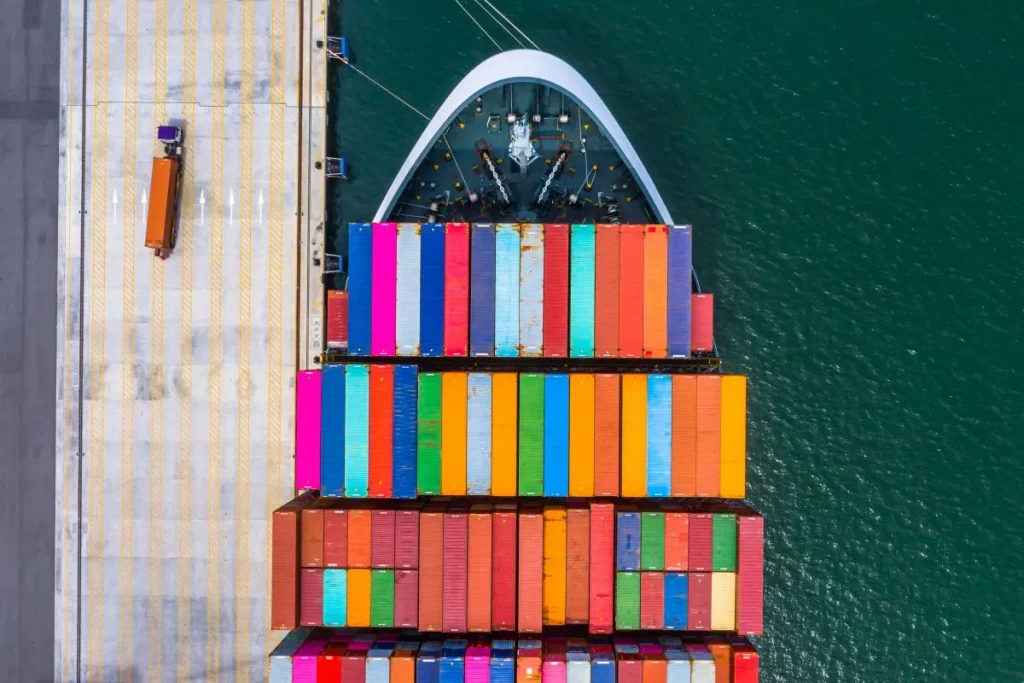

Understanding Free Zones in Türkiye

Free zones are designated geographical areas within Türkiye that operate under special customs and tax regulations, distinctly separate from the country’s standard economic territory. These zones function as international territories where goods can be manufactured, processed, stored, and traded without being subject to Turkish customs duties or value-added tax obligations.

The Turkish government established these zones to attract foreign direct investment, promote exports, create employment opportunities, and facilitate technology transfer. Currently, Türkiye operates19 free zones strategically located near major ports, airports, and industrial centers, each offering unique advantages based on their geographical position and specialized infrastructure.

What Is a Free Zone in Türkiye?

Free zones in Türkiye are specially designated areas considered outside the Turkish customs territory for customs and foreign trade purposes. They are established to promote export-oriented investment, increase foreign direct investment, and enhance Türkiye’s integration into global supply chains.

Companies operating in Turkish free zones benefit from substantial tax incentives, simplified customs procedures, and full foreign ownership rights. Free zones are particularly attractive for manufacturing, trading, logistics, software, R&D, and international services.

Key Advantages of Free Zone Company Formation in Türkiye

Free zone companies enjoy a unique legal and fiscal environment that distinguishes them from companies operating onshore. The primary advantages include:

- 100% foreign ownership with no local partner requirement

- Corporate tax exemption on income derived from export activities

- VAT and customs duty exemptions

- No restrictions on profit repatriation

- Transactions in foreign currency without limitations

- Simplified customs and logistics procedures

- Strategic geographic location bridging Europe, Asia, and the Middle East

Compared to standard company formation in Türkiye, free zone entities offer a highly optimized structure for international operations.

Types of Legal Entities in Turkish Free Zones

Investors may choose among several legal forms when establishing a presence in a Turkish free zone. The most commonly preferred options are:

Free Zone Joint Stock Company (A.Ş.)

A joint stock company formation is suitable for large-scale investments, international shareholders, and businesses planning future capital increases or public offerings.

Free Zone Limited Liability Company (Ltd. Şti.)

A limited liability company formation is ideal for SMEs and operational companies seeking flexibility and lower governance requirements.

Branch of a Foreign Company

For companies wishing to operate directly under their parent company’s legal identity, branch office formation in a free zone is a viable alternative.

Who Can Establish a Free Zone Company?

Both foreign and Turkish investors may establish companies in Turkish free zones. Free zone entities are particularly suitable for:

- Export-oriented manufacturers

- International trading companies

- Logistics and warehousing operators

- Software, IT, and technology firms

- R&D and design companies

- Regional headquarters and coordination centers

- Foreign subsidiary formation projects

Step-by-Step Free Zone Company Formation Process

Establishing a presence in a Free Zone requires a specific set of procedures distinct from standard company formation in Türkiye. Whether you are planning a limited liability company formation or a joint stock company formation, the process follows this clear structure:

Step 1: Secure an Operating License

Before proceeding with the free zone company formation, the applicant must first obtain an Operating License from the General Directorate of Free Zones, operating under the Ministry of Trade. This application involves presenting a detailed feasibility report that outlines the intended activities, investment plan, and projected impact on the Turkish economy.

Step 2: Choose Your Legal Entity

Investors typically choose between two main structures:

- Free Zone Branch: Foreign companies can opt to establish a branch office formation of their existing entity.

- Free Zone Company: Establishing a new Turkish company, often a Limited Liability Company (Anonim Şirket) or Joint Stock Company (Limited Şirketi), specifically for operations within the zone.

Our firm is proficient in assisting with every structure, including the more complex foreign subsidiary formation process.

Step 3: Formal Company Registration

Once the Operating License is approved, the legal entity must be formally registered with the relevant Trade Registry Office, much like an entity on the mainland. This involves preparing and notarizing a standard set of required documents for company formation.

Step 4: Secure a Lease and Commence Operations

The final steps involve securing a lease agreement for a suitable office/warehouse space within the chosen Free Zone and then obtaining the necessary permits to begin commercial operations.

Required Documents for Free Zone Company Formation

The documentation process is precise and must be handled carefully to avoid delays. Typical required documents for company formation include:

- Passport copies and shareholder information

- Articles of Association

- Power of Attorney (notarized and apostilled if abroad)

- Parent company documents (for branches and subsidiaries)

- Financial statements or activity reports

- Free Zone application forms

Document requirements may vary depending on the chosen legal structure and investor profile.

Taxation of Free Zone Companies in Türkiye

Free zone companies benefit from one of the most favorable tax regimes in the region. Key highlights include:

- Corporate tax exemption on export-based income

- Income tax exemption on employee wages (subject to export thresholds)

- VAT exemption on goods and services within the free zone

- Customs duty exemption

However, companies selling goods or services into the Turkish domestic market may become partially subject to standard tax rules. For detailed planning, our corporate taxation guide provides in-depth analysis and compliance guidance.

Costs of Free Zone Company Formation

The costs of company formation vary depending on several factors, including:

- Selected free zone

- Legal structure (A.Ş., Ltd., branch)

- Capital amount

- Office or warehouse size

- Professional service scope

Typical cost components include government fees, free zone license fees, legal incorporation costs, and operational setup expenses. For budgeting clarity, investors should review the costs of company formation in advance.

Banking and Financial Operations

Opening a corporate bank account is a critical step for free zone companies. Banks require strict compliance with anti-money laundering and KYC regulations. Proper preparation significantly reduces approval timelines.

Our team assists clients throughout the corporate bank account opening process, including document preparation, bank selection, and compliance coordination.

Governance and Ongoing Compliance

Although free zone companies benefit from tax and regulatory incentives, they remain subject to Turkish commercial and corporate governance rules. Ongoing obligations include:

- Statutory bookkeeping and accounting

- Annual corporate filings

- License renewals

- Employment and social security compliance

- Customs and export reporting

Working with experienced Turkish company formation lawyers ensures long-term compliance and risk mitigation.

Since 2017, Akkas CPA & Turkish Accounting Firm has remained Istanbul’s trusted partner for business establishment and financial compliance.

Beyhan Akkas, CPA & Accountant

Contact us for Free Zone Company Formation in Türkiye

With over three years of experience, Akkas CPA & Turkish Accounting Firm delivers integrated legal, corporate, and governance solutions for international investors. Our services cover the full lifecycle of free zone company formation, from initial feasibility to ongoing compliance and restructuring.

We provide multilingual support and tailored solutions aligned with each client’s strategic objectives, whether establishing a free zone company formation project or expanding through alternative structures.

If you are considering free zone company formation in Türkiye in 2026, we invite you to contact Akkas CPA & Turkish Accounting Firm. Our experienced company formation team will guide you through every stage of the process with clarity, efficiency, and full regulatory compliance.