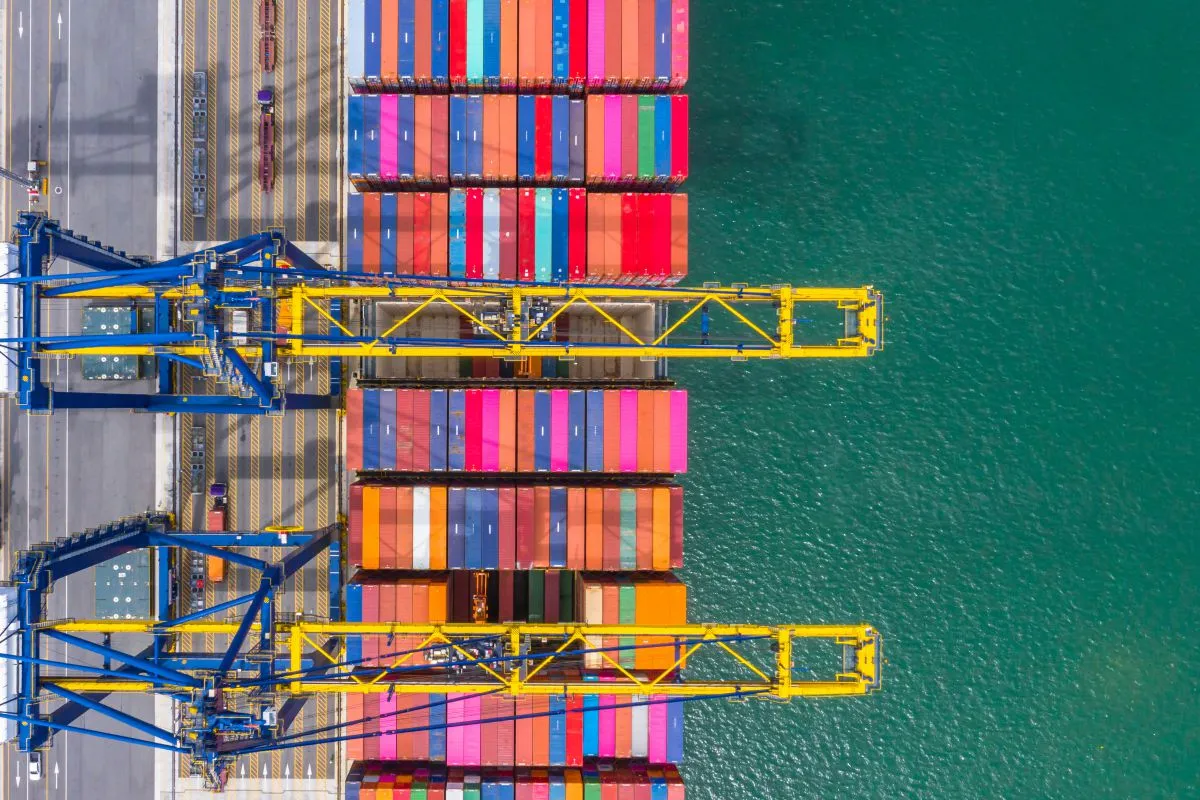

Türkiye remains one of the most attractive investment destinations bridging Europe, Asia, and the Middle East. However, operating compliantly in Türkiye requires strict adherence to tax registration and ongoing fiscal obligations. At Akkas CPA & Turkish Accounting Firm, we provide end-to-end tax registration services in Türkiye, ensuring businesses are properly established, fully compliant, and strategically positioned from day one.

With over three years of experience since 2017, our Istanbul-based, multilingual team advises foreign investors, multinational groups, and local entrepreneurs on every aspect of Turkish tax compliance within a broader corporate governance framework.

Table of Contents

- Understanding Tax Registration in Türkiye

- Who Must Register for Tax in Türkiye?

- Types of Taxes Covered Under Turkish Tax Registration

- Tax Registration Process in Türkiye: Step-by-Step

- Tax Registration for Foreign-Owned Companies

- Post-Registration Tax Compliance Obligations

- The 2026 Minimum Tax Regime

- Integration with Accounting, Banking, and Operations

- Strategic Banking and Capital Management

- Risk Management Through Governance and Contracts

- Common Tax Registration Pitfalls in Türkiye

- Why Choose Akkas CPA & Turkish Accounting Firm?

- Contact us for Tax Registration Services in Türkiye

Understanding Tax Registration in Türkiye

Tax registration is a mandatory legal process for any entity or individual conducting commercial activities in Türkiye. It involves registration with the Turkish Tax Office (Vergi Dairesi) and the issuance of a tax identification number (TIN), which is required to operate legally.

Tax registration is not a standalone process. It is closely linked with company incorporation, banking, accounting, employment, and regulatory filings, all of which must be coordinated carefully to avoid compliance risks and financial penalties.

Businesses often initiate tax registration simultaneously with company formation in Türkiye to ensure a seamless start to operations.

Who Must Register for Tax in Türkiye?

Tax registration is required for the following parties:

- Newly incorporated Turkish companies

- Branches and liaison offices of foreign companies

- Sole proprietors and freelancers

- Companies generating income in Türkiye

- Entities employing personnel in Türkiye

- Companies subject to VAT, withholding tax, or corporate income tax

Failure to register on time may result in administrative fines, retroactive tax assessments, and limitations on commercial activities.

Types of Taxes Covered Under Turkish Tax Registration

Once registered, businesses may become subject to several tax types, including:

Corporate Income Tax

Applicable to legal entities incorporated in Türkiye, currently levied on net profits.

Value Added Tax (VAT)

Applies to goods and services supplied in Türkiye, with standard and reduced rates depending on the transaction.

Withholding Taxes

Imposed on payments such as dividends, rent, salaries, professional services, and royalties.

Stamp Tax

Charged on executed contracts and certain official documents, making proper documentation essential.

Social Security Contributions

Mandatory for employers and employees, closely coordinated with payroll and tax filings.

Akkas CPA ensures all relevant tax liabilities are identified and registered accurately from the outset.

Tax Registration Process in Türkiye: Step-by-Step

1. Preliminary Legal Assessment

We first assess your business model, ownership structure, sector, and anticipated revenue streams to determine applicable tax obligations.

2. Company Incorporation Alignment

Tax registration is integrated into the incorporation process, whether for joint stock company formation or limited liability company formation, ensuring statutory timelines are met.

3. Address Verification and Lease Documentation

A registered business address is mandatory. Tax officers may conduct physical inspections to verify the operational premises.

4. Tax Office Registration

We submit all required documentation to the competent Tax Office, including articles of association, signature circulars, lease agreements, and incorporation certificates.

5. Issuance of Tax Identification Number

Once approved, the company receives its official tax number, enabling invoicing, banking, and commercial operations.

Tax Registration for Foreign-Owned Companies

Foreign investors face additional complexities due to cross-border tax exposure, double taxation risks, and compliance with international reporting standards.

Our Turkish company formation lawyers advise on:

- Permanent establishment risks

- Double taxation treaty applications

- Transfer pricing considerations

- Withholding tax planning

- Substance and economic presence requirements

We ensure that foreign-owned entities are structured efficiently while remaining fully compliant with Turkish tax law.

Post-Registration Tax Compliance Obligations

Tax registration marks the beginning—not the end—of compliance responsibilities. Registered entities must adhere to ongoing obligations, including:

- Monthly VAT returns

- Quarterly provisional tax filings

- Annual corporate income tax returns

- Withholding tax declarations

- Electronic invoicing and e-ledger compliance

- annual report filing

- and statutory disclosures

Akkas CPA coordinates these obligations with accounting & bookkeeping services to ensure accuracy and timely submission.

The 2026 Minimum Tax Regime

A significant development in 2026 is the implementation of the Domestic Minimum Tax. This ensures that corporate tax is not less than 10% of corporate income before certain deductions. Furthermore, for multinational enterprises, Türkiye has aligned with the OECD’s Pillar Two rules, introducing a 15% Global Minimum Top-Up Tax.

Navigating these “minimum tax” waters requires sophisticated tax planning. We provide strategic advice to ensure that while you stay compliant, you also utilize every legal deduction available to protect your bottom line.

Integration with Accounting, Banking, and Operations

Tax registration cannot function in isolation. Our holistic service model integrates tax registration with:

- bank account opening

- for operational and capital accounts

- Financial system setup aligned with Turkish GAAP

- Payroll and social security registrations

- Invoicing and expense tracking mechanisms

This integrated approach minimizes operational friction and ensures full financial transparency.

Strategic Banking and Capital Management

A corporate tax identity is meaningless without the ability to move funds. The process of bank account opening for foreign-owned Turkish companies has become more rigorous due to “Know Your Customer” (KYC) and Anti-Money Laundering (AML) regulations.

As your legal partner, we facilitate these introductions, ensuring the bank recognizes your tax registration and corporate status, allowing for seamless capital flow and dividend repatriation.

Summary of Tax Obligations (2026)

| Tax Type | Rate | Filing Frequency |

| Corporate Income Tax | 25% | Quarterly (Provisional) / Annual |

| Value Added Tax (VAT) | 20% (Standard) | Monthly |

| Withholding Tax | Varies (e.g., 20% on rent) | Monthly |

| Dividend Withholding | 10% (Subject to Treaties) | Upon Distribution |

Risk Management Through Governance and Contracts

Improper tax registration or incomplete documentation can expose companies to audits and penalties. We mitigate these risks by aligning tax compliance with:

- corporate governance

- best practices

- Proper board resolutions and internal policies

- Accurate and enforceable commercial documentation

Our team also supports clients with contract drafting & review to ensure tax-efficient and legally compliant agreements, particularly for service, distribution, and licensing arrangements.

Common Tax Registration Pitfalls in Türkiye

Businesses frequently encounter challenges such as:

- Incorrect tax office jurisdiction

- Delayed address inspections

- Incomplete documentation

- Misclassification of activities

- Failure to register for VAT or withholding taxes

Akkas CPA & Turkish Accounting Firm proactively addresses these issues, preventing costly delays and regulatory exposure.

Why Choose Akkas CPA & Turkish Accounting Firm?

Since 2017, Akkas CPA has advised thousands of domestic and international clients on entering and operating in Türkiye. Our tax registration services are distinguished by:

- Deep knowledge of Turkish tax and corporate law

- Multilingual legal and financial teams

- Seamless coordination with incorporation and accounting

- Practical, business-oriented advice

- Long-term compliance and governance support

We act not only as legal advisors but as strategic partners in your Türkiye operations.

Since 2017, Akkas CPA & Turkish Accounting Firm has remained Istanbul’s trusted partner for business establishment and financial compliance.

Beyhan Akkas, CPA & Accountant

Contact us for Tax Registration Services in Türkiye

Since 2017, Akkas CPA & Turkish Accounting Firm has been the premier choice for international businesses entering the Turkish market. Our multilingual team doesn’t just “file paperwork”; we act as your strategic advisors in Istanbul.

The complexities of the 2026 tax code shouldn’t be a barrier to your expansion. With our comprehensive tax registration services in Türkiye, you can focus on growing your business while we handle the intricacies of the Turkish Revenue Administration.

If you are planning to establish or expand your business in Türkiye, professional tax registration is a critical first step. We invite you to contact Akkas CPA & Turkish Accounting Firm to discuss your tax registration needs and benefit from our comprehensive, compliant, and investor-focused legal services.